Why Book-keeping & Accounting

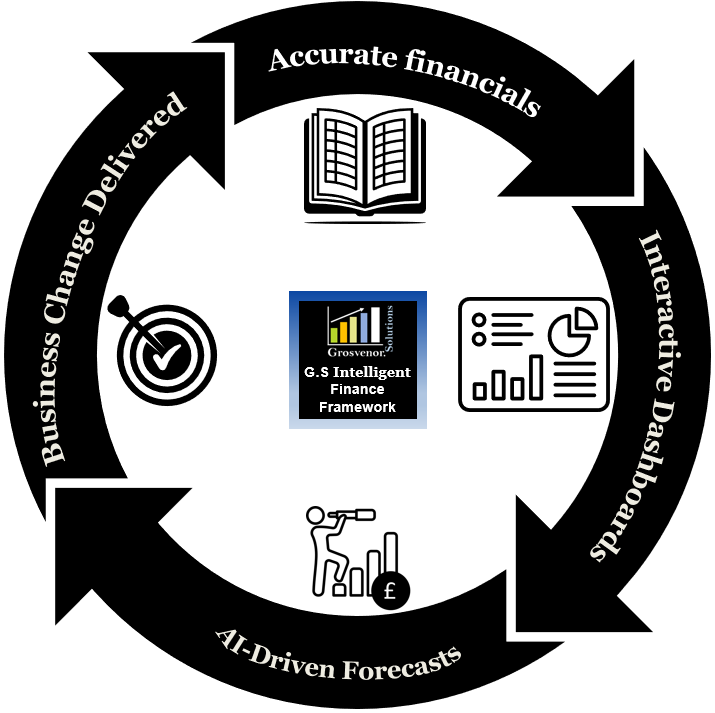

Accurate Numbers, Actionable Insights, Delivered Change.

Real growth isn’t just tidy books — it’s the ability to see what’s happening, predict what’s next, and act with confidence.

Our Intelligent Finance Framework starts with rock-solid bookkeeping, the pre-requisite to “Accurate Financials” and then layers on three capabilities most firms simply don’t have:

| Foundation & Add-Ons | What it means for you | Key Drivers/Dependencies |

|---|---|---|

| 1. Accurate Financials | Trust the numbers that drive every decision. Financials are accurate and complete. | Automation that creates value. Elimination of manual processes, re-keying, spreadsheet errors etc. |

| 2. Interactive Dashboards | Instant clarity in one click — to track the KPI’s associated to your business goals and objectives. | Interactive dashboard to see real-time data on your KPI’s. Few accountants build live data models or visuals. |

| 3. Business Change Delivered | Having achieved complete visibility on performance, if the numbers show something’s broken, we help fix it. | We have the accounting, IT/AI, project management and process skills to get you back on track if required |

| 4. AI-Driven Forecasting | The ability to see ahead and be Proactive rather than always be reactive. See problems before they arrive and fix them | Forecasts rely on high quality, clean and consistent data and integrated systems |

some features of our service

Always on Support

Your questions don’t wait — and neither do we.

Secure client portal

All your documents and messages in one safe, central place.

Online & Convenient

No need for meetings or paperwork — everything handled digitally.

Smooth contact

Whether it’s email, chat, or video — we fit into your workflow.

Upfront Pricing

No surprises. Know exactly what you’re paying before you start

Paperless

Ditch the shoeboxes — go digital and stay organised.

Modern tools & techniques

We use today’s tools to solve today’s problems — with speed and clarity.

Face-to-face, no travelling

Meet us via secure video calls, wherever you are

Fast response times

We don’t leave you waiting — get answers when you need them.

how we onboard new clients

and connect accounts

your books

& analysis!

our prices

We offer 3 different subscription plans as shown in the table below. Note prices are indicative and we can design bespoke services for you if none of the plans align to your needs.

Basic package

(From £100 per Month)

Ideal for entrepreneurs just starting out, the self-employed and small enterprises with fewer than 5 staff.

standard package

(From £175 per Month)

For businesses focused on growth that require monthly book-keeping, management accounting, payroll and tax compliance

advanced package

(From £350 per Month)

Suitable for growth businesses, who want to focus on their core activities and outsource most or all of their accounting function

Get in touch for a customised quote.

Compare our Plans

Where financial year ending is within 3 months an upfront 3-month subscription purchase is required

| Features | Basic Package | Standard Package | Advanced Package |

|---|---|---|---|

| Price | from £100/month | from £175/month | from £350/month |

| Reminder Service for deadlines | |||

| Confirmation Statements | |||

| Book-keeping | |||

| Dedicated Accountant | |||

| Accounting package subscription | |||

| Multi-Currency Support | £20/per month | £20/per month | |

| VAT Filing | |||

| Directors' Tax Return | |||

| Corporation Tax Return | |||

| Payroll & Pension Service | up to 5 employees | ||

| Management Accounts | |||

| Data Analysis & Business Insights | |||

| Bank Reconciliations | |||

| Purchase and Sales Invoice Processing | |||

| Management of Receivables and Payables |

Bespoke One-Off Accounting, Tax & Advisory Services

Not every business fits neatly into a monthly subscription plan.

That’s why we also offer a full range of one-off, project-based or ad hoc services — ideal if you just need expert support for a specific requirement.

Due to our ability to leverage deep IT and AI skills, we’re uniquely positioned to deliver one-off services that go beyond traditional bookkeeping, accounting and tax work. We can support you with deep financial expertise and help optimise the cloud systems, processes and data behind your business.

Core Accounting & Tax

- Year-end accounts

- Preparation of statutory annual financial statements

- Corporation Tax (CT600) filing

- VAT returns

- Payroll services

- Bookkeeping services (including clean-up and catch-up)

- Directors’ Self Assessment

- Personal tax returns / Self Assessment

Reporting, Systems & Power BI

- Power BI dashboard setup and management reporting

- Connecting cloud applications to eliminate data silos

- Ad hoc reporting solutions using Power BI and automation tools

- Business system audits and configuration reviews

- Cloud system migration and integration support

- Workflow automation and process improvement

Project-Based Advisory

- Financial support for acquisitions or investment decisions

- Business restructuring and cost-efficiency reviews

- Software implementation projects

- Data quality reviews and governance improvements

- One-off strategic advisory engagements

Companies House Filing

- Annual accounts submission

- Confirmation Statements

- Dormant company accounts

- Updating shareholder or officer information

- PSC register updates

Want to find out More about our services and prices?

Please get in touch directly for more information on how Grosvenor.Solutions can support your needs. We are more than happy to help